How I Sell Stocks from "A complete trading system in your hands: A guide to trading an hour a day"

My notes on Dr. Mansi video series.

Notes:

I have spent the past two years researching swing trading, a method I consider to be the optimal balance between effort and gains. My journey began with Kristjan Qullamaggie, a legend in the trading world, who introduced me to one of his esteemed teachers, Pradeep Bonde. Within this influential group, I discovered Dr. Mansi, whose ability to simplify and articulate complex trading systems stands out as exceptionally clear and insightful.

I spent a lot of time looking at the details and ended up with over 70 pages of Dr. Mansi's explanations. I've simplified it since then. As a joke, I wrote it as a book and asked Dr. Mansi if I could put it online. So here it is:

How I Sell Stocks

Plan your exit before entry!

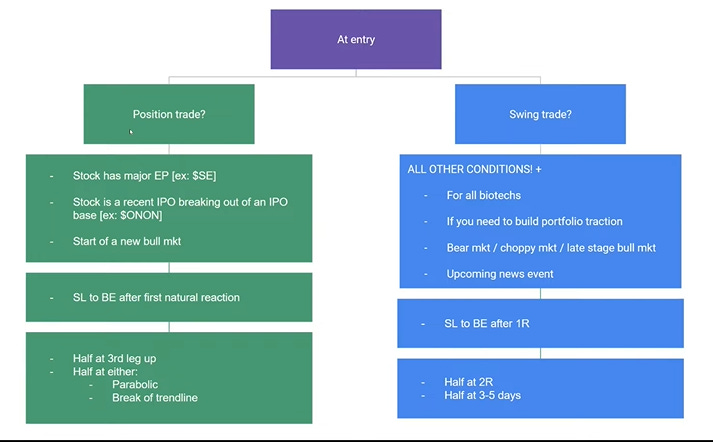

This depends on your strategy.

Position trade (like episodic pivot EP’s) = longer-term holding, like months.

Swing trades (like SIPs) = 3 to 5 days approximately.

Position Trade:

The stock has a major episodic pivot (life-changing news) or shows significant earnings potential.

The stock is a recent IPO (Initial Public Offering) breaking out of an IPO base.

The market is at the start of a new bull market.

Swing Trade:

The stock is uptrend and making higher lows.

The market is in a strong upward trend (bull market).

The stock is highly volatile, such as biotech stocks, and unsuitable for long-term positions.

If your portfolio is down and you need to build it up again. (“getting traction”)

Upcoming news events are coming soon.

Ney note: It's important to note that these criteria are subject to individual interpretation and might require traders to use their judgment based on market conditions and the specific characteristics of the stocks they are considering for trading.

When is it a Position Trade?

1st case of a Position Trade: Episodic pivot

Ney’s note: A stock has an “episodic pivot (life-changing news)” We call them EP’s not to be confused with “Earning per share”

You need analytical skills to determine if the news will positively affect the price for the long term in an episodic pivot. For example: Are there enough institutions holding it? What market are they in, etc.?

2nd case of a position trade: IPO

Another position trade could happen if you go over the IPO’s BASE.

One criterion is to consider recent IPOs breaking out of an IPO base. An IPO base is a period after a company goes public and its stock starts trading on the stock exchange.

*Daily chart

*weekly chart

3rd case of a position trade: New Bull Market

For position trades, one of the criteria is to consider the start of a new bull market. A bull market is characterized by rising prices and a generally optimistic sentiment among investors.

When is it a Swing Trade?

1st case of a Swing Trade: Biotech

Biotechs should always be treated as swing trades due to their volatile nature.

2nd case of a Swing Trade: build your account (“Create traction”).

If you need portfolio traction, be a Swing trader if your portfolio is not doing well. This is likely due to the market since the swing trading strategy doesn’t work well in a bear, choppy, or late-stage bull market.

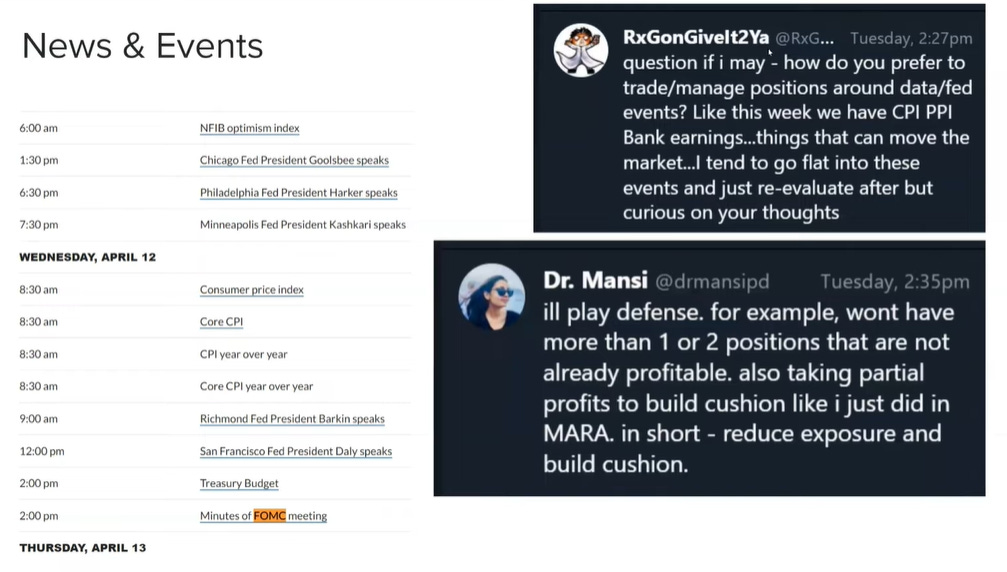

3rd case of a Swing Trade: News

Swing trade when news or events are nearby.

FOMC meetings that determine interest rates are the big events you want to watch.

NEY’s note: I use https://www.forexfactory.com/#upnext.

When to move the stop to breakeven?

Breakeven on a Swing trade:

Move the stop on an episodic pivot (Ep’s) after “a natural reaction.”

*notes added by Ney

You want to give episodic pivot (EP) space.

Sell half of the position after the 3rth leg.

Sell the other half if it becomes parabolic or breaks the trendline.

Ney Notes:(Why? Because the probability of a 4th leg or more diminishes greatly)

How to protect profits?

Move the stop there regardless if it's a position or swing trade every time there's a new swing low.

In Position Trades: sell Half at the 3rd leg up or a break of the trendline.

In a Swing trade: Sell Half at 2R* or after 3 to 5 days.

Ney’s note: statistically, most moves are 3 to 5 days long.

*R stands for “R multiple” - a multiple of the initial risk

In Position Trades: sell Half at the 3rd leg up or a break of the trendline.

We don’t like more than 3 legs up. (Statistically unlikely to continue)

3rd “leg” example:

Break Trend line.

A trendline conformed by three lows min:

Parabolic moves simply means that the angle of the trend changes.

We sell after the new trendline is broken because it is not sustainable.

Breakeven in a Swing Trade:

In a swing trade, move the stop loss to breakeven after +1R.

Sell half at 2R (now you have a free trade).

When to take a loss?

Your original stop gets hit. This is non-negotiable.

If there are not enough cushions at the end of the day (Cushion > 3 Average Daily Range (ADR) of that stock). Don’t risk a gap the next day.

The earnings report is coming out, and you are not 2R+ over your original entry.

The train is not arriving on schedule.

*not enough cushion means is too close to the stop loss. It could gap the next trading day.

*ER means the Earnings report is coming in the next day or two.

*Train not on schedule means the stock just goes sideways.

Now that you know when to sell… let’s see how much to bet:

Position Size from "A complete trading system in your hands: A guide to trading an hour a day"

Notes: I have spent the past two years researching swing trading, a method I consider to be the optimal balance between effort and gains. My journey began with Kristjan Qullamaggie, a legend in the trading world, who introduced me to one of his esteemed teachers, Pradeep Bonde. Within this influential group, I discovered Dr. Mansi, whose ability to simpl…